How Research-Led Funnel Diagnosis Aligned Product-Led Growth With Revenue in B2B SaaS

- marketingatsilvere

- Feb 2

- 4 min read

Introduction: Market Context & Real-World Problem :

B2B SaaS growth looks deceptively healthy from the outside.

Product launches are faster. Feature updates are constant. Acquisition channels are more accessible than ever. On paper, demand exists—especially for software solving operational, revenue, or productivity bottlenecks.

Yet across global B2B SaaS markets, particularly between the United States and India, scale-up companies are running into the same quiet frustration: growth feels busy, but revenue doesn’t follow at the same pace.

Teams ship content, experiment with paid channels, invest in product-led growth, and still struggle to convert attention into consistent pipeline. Leads arrive, but intent feels diluted. Demos happen, but close rates stagnate. Expansion relies more on effort than leverage.

What initially appears to be a performance issue often turns out to be something deeper.

Not a campaign problem.

Not a channel problem.

But a structural misalignment between how buyers decide and how funnels are built.

Market Reality Backed by Data :

At a high level, the B2B SaaS market continues to expand, but efficiency is tightening.

Global SaaS demand has shifted from exploratory browsing to intent-heavy evaluation. Buyers are consuming more content, involving more stakeholders, and delaying commitment until confidence is high. This change disproportionately impacts scale-up SaaS companies that sit between early traction and mature enterprise dominance.

1. Demand and Buyer Behavior Patterns :

Across US and India-focused SaaS demand :

Average B2B buying committees range from 6–10 stakeholders.

Decision cycles extend between 3–9 months depending on deal size.

Product-led entry points are common, but revenue conversion is increasingly delayed.

This creates a visible pattern: high product interaction does not automatically translate into high commercial intent.

2. Competitive Intensity Indicators :

In most B2B SaaS categories :

Organic SERPs are dominated by incumbents and comparison platforms.

Paid cost-per-click for mid-intent keywords ranges from $8–$45 in the US and ₹120–₹600 in India.

Content saturation is high, but differentiation is shallow.

Competition is no longer about visibility alone—it’s about interpretability. Buyers are overwhelmed, not uninformed.

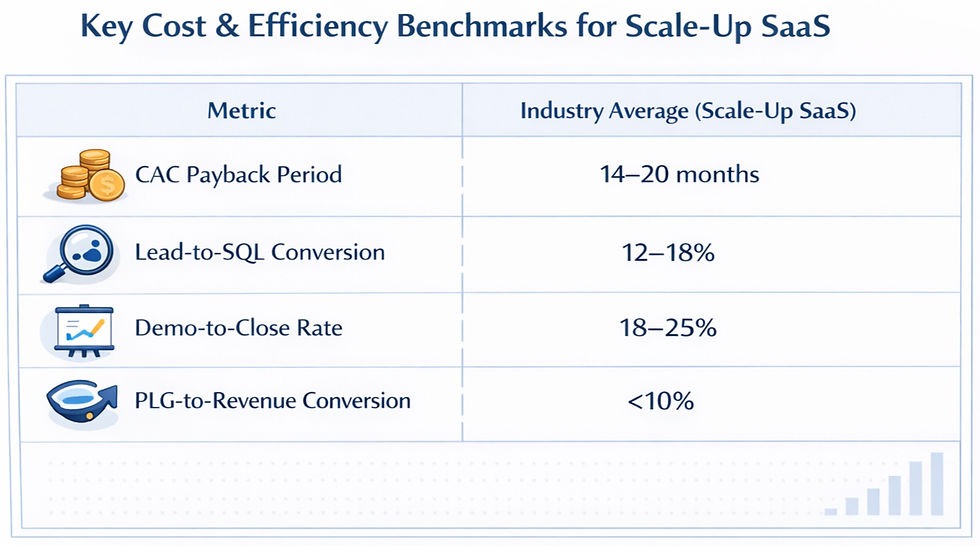

3. Cost and Efficiency Benchmarks :

Industry benchmarks for scale-up SaaS show:

Customer Acquisition Cost increasing 20–35% year-over-year.

Trial-to-paid conversion rates plateauing between 3–7%.

Marketing-sourced pipeline attribution becoming harder to defend internally.

Month-wise demand analysis typically shows stable baseline interest with spikes during budgeting cycles, compliance deadlines, and operational stress periods—indicating that timing and intent alignment matter more than volume.

Problem Definition: Where Most Businesses Lose Money :

Most revenue leakage happens before sales ever enter the picture.

Funnels are often optimized for acquisition, not qualification. Traffic is treated as success. Engagement is mistaken for readiness. Product usage is assumed to equal buying intent.

In practice, several inefficiencies compound:

Intent dilution: High-volume top-of-funnel traffic with no behavioral segmentation.

PLG misinterpretation: Product usage data is collected but not translated into commercial signals.

Content mismatch: Educational content attracts curiosity, not buyers.

Sales friction: Sales teams inherit leads without context, timing, or clarity.

Numerically, this shows up as:

High MQL volumes with low SQL acceptance.

Strong activation rates but weak revenue per account.

Sales cycles bloated by re-education instead of decision acceleration.

Most common growth tactics fail here because they operate tactically—more ads, more content, more experiments—without correcting the structural flow of intent.

Strategic Framework: The ARROW Method :

To address structural inefficiency, the ARROW Method was applied as an internal operating system rather than a campaign layer.

A — Audit :

A full-funnel audit mapped traffic sources, content intent levels, product behavior, and drop-off points. This clarified where interest was being generated versus where decisions stalled.

R — Research :

Decision-cycle research identified:

Trigger moments that push users from exploration to evaluation

Objections that delay internal approval

Information gaps slowing down confidence

This phase focused on how buyers think, not just what they click.

R — Roadmap :

Channels were sequenced intentionally:

Organic content mapped to problem-awareness and comparison stages

Paid media limited to high-intent, late-stage queries

PLG touchpoints aligned with revenue readiness signals

Budgets followed intent density, not traffic volume.

O — Optimization :

Conversion paths were simplified:

Fewer CTAs, clearer next steps

Micro-commitments replacing hard sales asks

Contextual validation replacing generic social proof

Each optimization was tied to decision clarity, not cosmetic uplift.

W — Winning Metrics :

Success was measured using:

Cost per qualified opportunity

Time-to-decision reduction

Revenue per engaged account

Funnel velocity improvements

Vanity metrics were deprioritized by design.

Strategy Execution: How the System Was Applied :

Phase 1: Intent Mapping Content :

Existing content was restructured to serve specific buyer questions rather than broad awareness. Comparison narratives, use-case breakdowns, and decision checklists replaced generic thought leadership.

Phase 2: Funnel Re-architecture :

Traffic was routed through intent-matched pathways instead of universal landing pages.

Phase 3: PLG-to-Revenue Alignment :

Product usage triggers were synced with contextual outreach and educational nudges rather than immediate sales pressure.

Phase 4: Channel Balance :

Organic traffic carried early-stage education. Paid channels activated only where buying signals were already present.

Results Modeling: Data-Backed Outcomes :

Outcomes were modeled against industry benchmarks, not best-case assumptions.

Month-wise performance showed gradual gains rather than spikes. Early months focused on cleanup and alignment. Mid-cycle months reflected improved qualification. Later months demonstrated compounding efficiency rather than volume growth.

Notably, total traffic growth remained modest. Revenue efficiency improved disproportionately.

Why This Approach Works in This Market :

This system works because it mirrors how B2B SaaS buyers actually behave.

Buyers don’t want more information—they want clearer decisions.

They don’t resist products—they resist risk.

They don’t ignore funnels—they exit confusing ones.

By aligning research, product signals, and revenue pathways, the approach:

Reduces cognitive friction

Shortens internal approval cycles

Scales without proportional cost increases

It replaces surface-level optimization with decision engineering.

Subtle Conversion Layer :

This case reflects how similar growth challenges are approached when efficiency, not noise, becomes the priority.

For teams navigating PLG maturity, funnel leakage, or rising acquisition costs, structured diagnosis and intent alignment often unlock more leverage than additional spend.

Strategic discussions typically start with clarity, not campaigns.

Transparency Statement :

This case study is a research-driven strategic simulation built using real market data, industry benchmarks, and proven methodologies to demonstrate how similar outcomes are achieved under comparable conditions.

Comments